OPC - The Future

- Gaurav R & Co

- Apr 12, 2021

- 3 min read

Impact of Union Budget 2021-22 on One Person Company (OPC)

Background

The idea of OPC is a revolutionary idea introduced by the Companies Act 2013 on the recommendation of the expert committee headed by Dr. J. J. Irani in 2005. In the erstwhile Companies Act 1956, minimum two directors and shareholders were required to incorporate a company. Whereas, now a company can be formed with only one person as a director and shareholder. So, it seems a kind of new platform is given to new innovative minds to start their business activities without indulging others and expected to fritter away his time, energy and resources on procedural matters because these companies have less compliance burden than private limited companies.

OPC is often referred as ‘One Man Show’ because as the name suggest it has only one person as a member. Section 2(62) of the Companies Act 2013 provides that “One Person Company” means a company which has only one person as a member.

The Hon’ble Finance Minister in her Budget speech proposed several significant changes in the area of corporate laws.

In her speech, Hon’ble Finance Minister said with respect to OPC:

“As a further measure which directly benefits Start-ups and Innovators, I propose to incentivize the incorporation of OPCs by allowing OPCs to grow without any restrictions on paid up capital and turnover, allowing their conversion into any other type of company at any time, reducing the residency limit for an Indian citizen to set up an OPC from 182 days to 120 days and also allow Non-Resident Indians (NRIs) to incorporate OPCs in India.”

Amendments in Companies Act, 2013 for OPCs applicable w.e.f. 1st April 2021

As a measure to directly benefit Start-ups & Innovators in the country, especially those who are supplying products & services on e-commerce platforms, and in order to bring in more unincorporated businesses into the organized corporate sector, provisions relating to incorporation of OPCs has been incentivized to allow OPCs to grow without any restrictions.

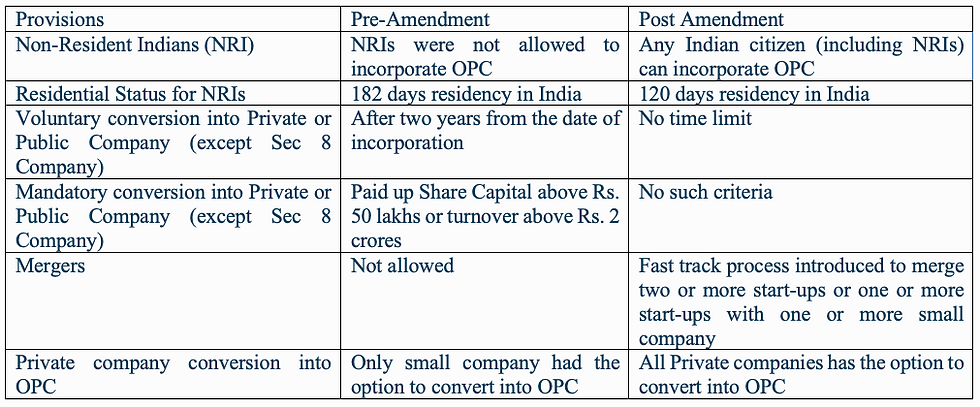

The change in provisions is summarized below in the following table:

These amendment with respect to OPC will give relief to these companies as the threshold limit of paid-up share capital and turnover being removed and there can be any limit of funding without hanging sword on head for conversion. Additionally, amendment allows foreign investors in the form of NRIs OPCs in India.

Pros & Cons of an OPC

Pros

1. OPCs were created to encourage formal incorporation of sole-proprietorship companies with a limited liability structure. But with the latest amendment, start-ups and innovators can also benefit from it.

2. The provision on setting up OPCs without the limit of paid-up capital and turnover would boost to the ‘Make in India’ initiative.

3. The reduced compliance burden and absence of Annual General Meetings will surely enable the new founders to be more focused on building their business.

4. It is expected to boost the gig economy culture across small towns as more women entrepreneurs and homepreneurs will be empowered by this.

5. OPC is free from stringent legal compliances such as quorums, mandatory rotation of auditor.

6. The liability is limited to the extent of shareholding. Thus, OPC allows an individual to take risks without risking his/her personal assets.

7. It gives suppliers and customers a sense of confidence in business.

8. Banking and financial institutions prefer to lend money to the company rather than proprietary firms.

9. With complete control of the company with the single owner, this leads to fast decision making and execution.

Cons

1. Since OPC means one man company, it may not be helpful at the time of raising funds. The moment the founder has to raise capital, he or she may find it difficult and may have to move to a private limited company.

2. OPC cannot carry NBFC activities

3. OPC cannot be converted into Section 8 company

4. Incorporation of OPC require lots of documents similar to private limited companies.

5. A person cannot incorporate or become nominee in more than one OPC.

Annual Compliances for OPC

1. Filing Form AOC 4 & Form MGT 7A within 180 days from the closure of the financial year.

2. Statutory Audit of Financial Statements.

3. Filing Income Tax Return.

4. To hold one Board Meeting in each half of the calendar year and the gap between two board meetings shall not be less than 90 days.

5. No requirement to hold Annual General Meeting. However, it may hold it voluntarily on or before 180 days from the closure of the financial year.

On the analysis of the impact of amendment of OPCs, we can categorically say that Future is with OPCs.

Comments